The Incredible VA Home Loan Benefit

Glenn Leach (NMLS 112932 & 1907) is a Top Producing Loan Officer with the largest VA lender in the country. He has been doing mortgage lending for 22+ years. He is a certified teacher with endorsements in History, Economics, Social Studies, English, & Language Arts, and he just completed a Master’s Degree in Strategic Communications from Washington State University (April 2025 – Building this website was one of his final projects for that degree).

The “VA Battle Plan” book series (Find out more in the “My Books” section) was written to educate and encourage VA clients and the Real Estate Agents who want to serve them. Inspiration came from these horrifying statistics

“Only 24% of VA-eligible borrowers who apply for a home loan actually end up doing a VA loan”, and “Only 13% of Veterans EVER utilize their VA Home Loan Benefit”.

There is no excuse for this. The VA loan is almost ALWAYS the best lending option for Veterans, and the percentage of eligible borrowers who don’t get one points to way too much industry complacency and ignorance.

Glenn began his career as a Loan Officer in 2002. From 2010-2014 he was awarded the Premier Partner honor from Washington State Housing Finance Commission for being Top 10 in the State of Washington for Down Payment Assistance originations. In 2015 he began his focus on VA loans working for the largest VA purchase lender in the country.

He met his Bride of 40+ years at a music competition during high school and they have been making beautiful music together ever since. He loves spending time with his 3 adult children, his two incredible grandchildren, and misses his long-time companion wiener dog Lily. Time spent singing, gardening, and hiking outdoors with his wife in the beautiful Pacific Northwest and National Parks around the country, and running on his NordicTrack Treadmill bring joy and balance to the hectic life as a producing loan officer.

His business motto:

“And my people shall dwell in a peaceable habitation, and in sure dwellings, and in quiet resting places.” Isaiah 32:18

If you own a home and are eligible for VA financing, this workbook explains the five top options you have to continue to grow your wealth using your amazing VA benefit. It’s a workbook because it has worksheets you can use to take a personal look at each of the options. A quick 30 page read packed with great information and inspiration. All of the concepts here are more fully explained in my upcoming book, “VA Homeowner BATTLE PLAN”, which has expanded explanations, additional concepts and options, and of course fun and amazing stories that relate to these ideas and that are just, well, fun and amazing.

We’re entering a housing market set to explode with potential and wealth-creation. This workbook will get you primed to take advantage of what is coming and truly MAXIMIZE that incredible VA HOME LOAN BENEFIT that you’ve earned. Available on Amazon.com. Get yours today.

Order a copy here.

The first and obvious question is, What Is A Preapproval? A preapproval basically means that I believe you can buy a home that is priced up to a certain amount. The preapproval is based on your credit report and the information you have provided so far. Your loan officer may not have all your information, and some of the information you provided may be wrong, so a preapproval is not a guarantee that your loan will actually end up being approved. But a good loan officer can ask the right questions and be pretty sure how much you can afford.

The preapproval is your ticket to start shopping for a home. So, start shopping. But while you’re doing that, you’ll be asked to provide proof that your application is correct and complete. So, watch your email for lists of items needed for your file and paperwork for you to sign. The sooner you complete your tasks, the sooner your loan officer can know for sure that the preapproval is justified.

Once your items are provided, they will be reviewed by the loan officer and the processing team. The processing team will do the behind-the-scenes verification stuff just to make extra sure we’re ready to go. Your loan team doesn’t need to wait for you to find a property to do all this verification. But once you find your property, the underwriter is the ultimate judge of your file, and your loan team will want a nice complete file before going to underwriting. Don’t delay doing your part and getting your items submitted because once you have a home under contract, strict deadlines start to apply. That means your file needs to get submitted to underwriting quickly at that point, and a file with too many missing items will give a bad first impression to the underwriter and make your file tougher. Once the underwriter is satisfied that your file is worthy and the appraisal comes in good, you’re ready to close. Getting things in order sooner allows your file to be ready to close sooner and takes much of the stress out of the process for you.

Since the current market is so competitive, it’s nice when you can tell potential sellers that your credit application is complete and it’s ready to go to underwriting right away. That is much stronger than just having a preapproval letter – and listing agents do call loan officers all the time when they are considering your offer. I don’t blame them because frankly, many preapproval letters aren’t worth much when they are done by lenders who don’t know what they are doing – and there are a lot of lenders who don’t know what they are doing. I used to be a lender who didn’t know what I was doing too!

Many years ago, my first boss told me, “Just tell them they are approved! Hopefully you can get the loan done and get paid. But if you can’t, you just deny them and move on.” That’s really how he operated. Sad, but true. I prefer to make sure you’re good to go before you find a home!

There are a lot of shoppers trying to buy the same home that you are looking at. Anything you can do to make your offer stronger you should to do. So, get your documents in quick and you can be confident your loan will actually get approved and close!

Please help me by sharing your story! Did your VA loan make you a millionaire? Maybe a parent served and bought a home with VA and are now living a full retirement with no house payment? Maybe your story is negative, like the time you applied for a VA loan and your loan officer talked you out of it or your real estate agent told you that sellers don’t accept VA offers? Please email me your story for the book.

Email: Glenn.Leach@VU.com

The book answers the question, “Now that you own a home, what do you do now to keep growing your wealth and maximizing your VA home loan benefit.

I LOVE to share stories, so could you share YOUR with me story for the book? What has home ownership meant to you and your family? Has it helped you grow your wealth? Did you use a refinance to improve your situation? Have you purchased multiple properties? Do you own multiple properties now? Tell me your story so I can use it to encourage and advise other homeowners and homebuyers.

The “VA BATTLE PLAN” series includes “Credit Score BATTLE PLAN” for the credit-challenged applicant who wants to qualify for a home; “VA Homebuyer BATTLE PLAN” for someone who wants to buy a home; “Real Estate BATTLE PLAN” for real estate agents who want to win and serve more VA clients; and Book #4 (coming soon) “VA Homeowner BATTLE PLAN” for folks who already own a home and wonder what to do next to maximize their VA benefit.

“The VA home loan benefit is WAY more than just a zero-down home loan benefit” – and this book will show you how to grow your wealth even more using little-known secrets of the VA program. For the first 13 years of my mortgage career, I didn’t know most of this stuff, so be prepared to say, “I wish I knew this sooner”. (Sorry it has taken me so long to write this.) I look forward to hearing your stories.

Find out more at https://new.express.adobe.com/webpage/s5jC7SD2nQz8I

But Zero Down Payment is a big one! Learn more in my book VA Homebuyer Battle Plan!

You’ve been preapproved to go shopping, but just how long is your preapproval good for? The short answer is, “Until your situation changes”. Okay… But what does that really mean? It means that if you’re good to go today, then you’re good to go once you find a home if there are no changes to your application file.

Things that can change along the way are things related to Credit, Income, Employment, Assets, Liabilities, and Family Situation. Let’s start with Credit: You forgot to pay a credit card bill on time, and they reported you late to the credit bureaus. That could tank your credit score so you may not qualify anymore, or you may only qualify at a higher interest rate. That would be a “situation changes” sort of thing. Another classic case is where you pull up to the final walk-through of the home you’re trying to buy in your BRAND-NEW CAR! That new car loan debt could change your credit situation so you no longer qualify. Many buyers don’t realize that your mortgage lender gets notified if someone pulls your credit – so we’ll see it and have to find out what happened.

Income and Employment changes can impact your situation as well. If you get a nice job offer while you’re shopping for a home, should you take it? If your car breaks down and you need another one, should you buy one? Some lenders and helpful real estate agents will tell you that you can’t do ANYTHING until your loan closes, and that isn’t true. My best advice is, BEFORE you do anything like add more debt or switch jobs, ASK YOUR LOAN OFFICER BEFORE YOU DO IT! We are not here to catch you doing something bad or prevent you from living your life! We’re here to help! So, we can get the facts and see if that “situation change” will impact your preapproval or not.

Another classic problem is changes is assets. If you’re planning on using some of your own money for the loan, changes in assets can create problems. Obviously, if you spent your down payment that you were planning to use and we based your preapproval on you having that money, that’s something you should let us know. But the #1 problem we have with assets is when WE CAN’T VERIFY WHERE YOUR MONEY CAME FROM. Mysterious deposits that show up in your bank accounts that we can’t prove what they are? Big problem. Maybe your parents get excited about your purchase and surprise you with a gift to help with the costs. HOLD ON THERE!!! Before you do ANYTHING with that money – talk to your loan officer! With the Federal Government’s “Patriot Act” rules to combat terrorism and money laundering, we have to account for any and all money used in a mortgage loan. It may or may not be a problem for your file, but please find out before you do anything with surprise money. I could tell you horror stories about this one…

I mentioned “Family Situation”. That one sounds weird, so what are some file land mines with “Family Situation”. A common one is getting married during the home shopping process. I’m a romantic at heart and I love a good wedding, but in some cases – especially in what are known as “Community Property States” – uniting with your sweetheart in marriage can mean you are marrying his/her debts and credit scores (a bit complicated to explain all the possibilities here). On the other hand, marrying may actually improve your purchasing power too. So, like with other things, check with your loan officer before you walk down the aisle together.

One other “Family Situation” has to do with childcare or child support payments. These may be considered “debts” for your file, and we won’t see these on your credit report, but during the file processing, we will very likely uncover these things. If you have these obligations – paying for childcare or paying child support – please bring it up early so we can make sure the file doesn’t blow up during the process.

I’ve written a new workbook, that will be coming out along with my new “VA Homeowner BATTLE PLAN” book, that gives you some tools to analyze your own situation. Here I’ll post some sneak peaks.

The first of the “5 Options” is to “Stay and Do Nothing”. That doesn’t sound like much of an “Option”, but for many of you, it is the perfect option. There are two reasons why the “Stay and Do Nothing” option can help you grow your wealth: 1. Appreciation, and 2. Amortization.

For Appreciation, your home will continue to go up in value. I see the dire predictions of a housing market crash, and I really don’t see one coming. I don’t even see slightly lower values coming. If we did have a small decrease, it would be temporary at best. I have lots of data to back that up – it’s not hopeful thinking – but that is too much info for this post. So, staying put will grow your wealth because all of that higher value is YOURS to keep.

For Amortization, just continuing to make your mortgage payment is growing your wealth. Part of each payment comes back to you some day. It’s like a forced savings account. As you pay down the loan, you owe the bank less and less, meaning when you sell the home someday (or your kids do), ALL of that lower balance is YOURS to keep as well.

If you’re living in the perfect home, and you have the perfect loan, just keep enjoying your wealth going up. But if you’re not in a perfect home or don’t have the perfect loan, maybe one of the other 5 Options will work better. How do you decide if you have the perfect home for you? I’m going to recommend using a decision tool that one of America’s GREATEST decision makers used. In fact, he was such a good decision maker that he made most of his vast wealth selling his ideas. Truly a great man – BENJAMIN FRANKLIN!

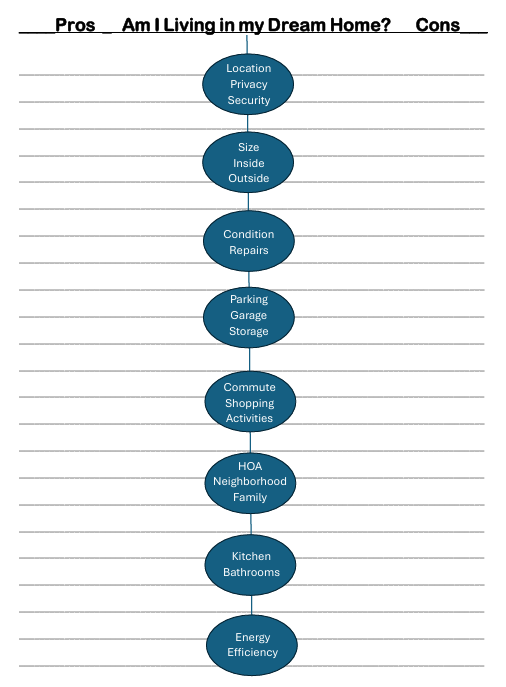

Here is Franklin’s decision tool:

I added some ideas to think about as you fill this out. Here’s how you use this tool as taught by the great man himself:

1. Divide the page in half and write “Pro” on one side and “Con” on the other. (I did that for you.)

2. Write down all the pros on one side and all the cons on the other.

3. Give each item a score from 1-3 based on how important the item is (1 is very important, 2 is pretty important, and 3 is somewhat important.)

4. Compare each side by crossing out pros vs cons that are equal in value (For example, if you have six pros that are “1’s” and four cons that are “1’s”, you will cross out four of these “1’s” on each side, leaving you two “1’s” on the pro side.)

5. Do the same thing with “2’s” and “3’s”.

6. Now you have some “1’s”, “2’s”, and “3’s” left on each side. The last step is to do a little math:

a. All “1’s” equal two “2’s” – cross out accordingly.

b. All “2’s” equal two “3’s” – cross out accordingly.

c. And per this math, that means that all “1’s” equal four “3’s”, or one “2” plus two “3’s”.

7. Go step-by-step, you’ll get it. When you are done, only one side will have any remaining items on it, OR you’ll have a few items remaining on each side but one side will have items that total up to be more important. Franklin recommended that you take 3-4 days to see if other reasons occur to add to the list, but if nothing changes by then, Congratulations, you have a winner!